What is Intrinsic Value?

Intrinsic value, also known as unascertainable value or fundamental value, is a measure of the worth of an asset independent of market fluctuations. It’s the potential long-term value of that asset based on its competitive advantage, unique features, and other positive factors. Intrinsic value investors focus on assets with strong fundamental values that are undervalued by the market. Investors who follow this strategy have some similarities to growth investors, but they look for different things when analysing a company and its stock. Both strategies can be successful in the right circumstances.

[ez-toc]

Value & Meaning

In its purest form, intrinsic value would be the price a company would fetch if it were to be liquidated and every asset were sold off. The idea is that the price paid for the shares should reflect the value of the company’s assets, and any excess above that is profit for the investors. When a company is sold, the price for its shares is supposed to be the same as the total value of the company’s assets. But the reality is that things don’t work this way. Shares are traded in the market, and they’re priced based on supply and demand. Intrinsic value is the amount that the shares should trade at if they were traded like inventory items.

Start-up guide for Intrinsic Value

Why Does Intrinsic Value Matter?

Intrinsic value is a critical concept for a newbie investor to lear in the markets to while looking at companies and spotting deals that suit with their investing goals. Applying models that concentrate on fundamentals offers a realistic perspective on the price of a company’s shares, even though they are not a perfect predictor of its performance.

Investors who focus on intrinsic value believe that markets overreact to short-term developments, causing stocks to become overvalued or undervalued. With an investment in a company’s long-term future in mind, investors who focus on intrinsic value are likely to buy stocks at a lower price than the market price. They sell when the stock price rises to the level of their original purchase price, taking their profits and helping them achieve their investment goal.

When the stocks of these companies rise in price, their investors make a profit even though these stocks aren’t growing rapidly.

Analysts use techniques to determine if a firm’s intrinsic value is greater or less than its current market price, which enables them to label it as “overvalued” or “undervalued.” A n adequate margin of safety may be determined when estimating an asset’s intrinsic value, where the market price is lower than the anticipated intrinsic value.

With a “buffer” between the lower market price and the estimated price of the stock, investors lessen the amount of loss they could have experienced if the stock turns out to be worth less than anticipated.

An investor can identify a firm that has solid fundamentals paired with Discounted Cash Flow (DCF) potential. That year it traded for $15 per share, and after calculating its DCF, intrinsic value is closer to $20 per share: a discount of $5. Assuming a margin of safety of around 35%, investors would acquire this stock at $15 value. If its intrinsic value lowers by $2 a year later, still a saving of at least $3 from initial DCF value and an adequate space to sell if the share price declines with it.

And, for a newcomer to the markets, intrinsic value is an important idea to remember while analysing companies and discovering deals that match within his or her investing goals. Though not a perfect predictor of a company’s performance, using models that concentrate on fundamentals gives a realistic perspective on its share price.

How to Find Intrinsic Value Investments

To find stocks with strong intrinsic values, investors are advised to choose companies with sustainable competitive advantages and strong fundamentals. A company’s profits are largely based on its ability to deliver better products and services than its competitors and charge a higher price as a result. Investors who buy companies with sustainable advantages are likely to make more money over the long term as demand for their products increases.

While it would be nice to find companies that are infallible, these are few and far between. Investors who follow the Intrinsic Value strategy must decide how to deal with their findings: they can either look for companies with strong intrinsic values in industries that are not expected to grow, or invest in companies in growing industries without strong intrinsic values.

The second approach is more likely to produce higher returns in the short term, but comes with a higher risk of loss.

What is a stock’s intrinsic value?

The intrinsic value of a stock, or a firm, is the total value of all its predicted future cash flows – with the discount rate applied. The intrinsic value simply evaluates the business’ variables (earnings and dividends) rather than any conjecture and comparisons to other companies in the industry.

Financial experts will construct models to estimate the intrinsic value of a stock, outside of its apparent market value. The traders that utilise these models as part of their strategy are known as ‘value investors’ or ‘value traders’. The argument is that any differences between the underlying value of a stock and its present market price may be exploited for profit.

How does intrinsic value vary over time?

As a firm’s earnings performance changes, so will its intrinsic value. If a firm has strong periods of growth that increase its cash flow estimates, its intrinsic value will grow. Likewise, if the firm endures a time of decline and incurs huge losses, its intrinsic value would plummet.

It’s crucial to remember that changes in the intrinsic value of a firm can not be reflected in its share price. For example, certain firms – like start-ups – frequently incur significant losses for years, yet their share values explode on the basis of speculation.

Why do shares of firms trade above their real value?

Shares that trade above their intrinsic value are ‘overvalued’. This occurs when the market price is influenced by irrational or emotional decision making that doesn’t represent the intrinsic value.

Although investors and traders don’t want to pay over the odds for shares, they might be swept up within the frenzy around a company. This is what occurs in speculative bubbles. Eventually, an expensive stock will drop in price. This is known as a stock market correction.

What happens when a firms stock trades less than its intrinsic value?

A stock selling below its intrinsic value is known as an undervalued stock. An undervalued company isn’t in financial trouble, but its share price does not represent its current profits.

Once investors recognise a company is inexpensive, they’ll join the market and the share price will surge. Identifying equities below their real value and taking advantage of the upswing may be a terrific method for making income. But it might be difficult to determine when a share price will rise.

Calculation of Intrinsic Value

Dividend Discount Models (DDM)

Many approaches estimate the fundamental value of a security factor in variables mostly pertaining to cash and utilize the time value of money.

The basic formula of the DDM is as follows

Value of stock= EDPS / (CCE−DGR)

where

EDPS = Expected Dividend Per Share

CCE = Cost of Capital Equity

DGR = Dividend Growth Rate

Gordon Growth Model (GGM)

The firm in context is assumed to be in a stable state with continuous dividends in perpetuity.

P=(r−g)D1

where

P = Present value of stock

D1 = Expected dividends one year from the present

R = Required rate of return for equity investors

G = Annual growth rate in dividends in perpetuity

As the name indicates, it accounts for the dividends that a business pays out to shareholders, which reflects on the firm’s capacity to create cash flows. There are more than one variant of this model, each of which factors in different variables, depending on what assumptions is intended to include. Despite its quite basic and optimistic assumptions, when applied to the evaluation of blue-chip businesses and broad indexes, the GGM has strong points.

Residual Income Model (RIM)

Yet another technique of determining this value is the residual income model.

The important aspect of this methodology resides in how its valuation approach produces the value of the stock based on the difference in profits per share and per-share book value (in this example, the security’s residual income) to arrive at the intrinsic value of the company.

Fundamentally, the methodology aims to identify the intrinsic value of the company by combining its present per-share book value with its discounted residual income (which may either lower the book value or enhance it)

V0=BV0+∑(1+r)tRIt

where

BV0 = Current Book Value of a company’s equity

RIt = Residual Income of a Company at a given point of time (t)

r = Cost of equity

Intrinsic Value and Current Market Value: How Different?

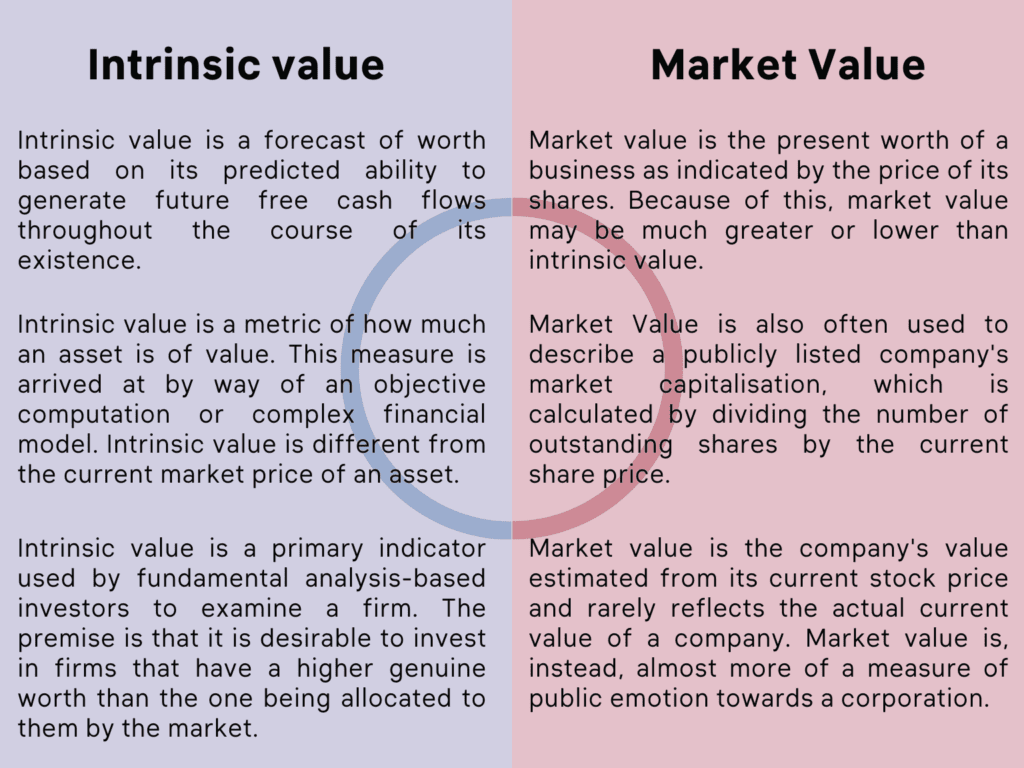

Though both are methods of assessing a firm, there is a substantial distinction in intrinsic value and market value. A firm’s intrinsic value is a forecast of worth based on its predicted ability to generate future free cash flows throughout the course of its existence. Whatever the market decides to value it at a certain moment, it still has an internal worth.

Intrinsic value is a metric of how much an asset is of value. This measure is arrived at by way of an objective computation or complex financial model. Intrinsic value is different from the current market price of an asset. However, comparing it to that current price can offer investors a sense of whether the asset is undervalued or overvalued.

There is an inseparable degree of complexity in figuring out a company’s intrinsic worth. Owing to all the different possible variables included, such as the worth of the company’s intangibles, estimations of the true value of a business can vary substantially amongst analysts.

Market value is the present worth of a business as indicated by the price of its shares. Because of this, market value may be much greater or lower than intrinsic value. The term “market value” is also often used to describe a publicly listed company’s market capitalisation, which is calculated by dividing the number of outstanding shares by the current share price.

Market value is the company’s value estimated from its current stock price and rarely reflects the actual current value of a company. Market value is, instead, almost more of a measure of public emotion towards a corporation. The reason for this is that the market value reflects supply and demand in the investing market, how keen (or not) investors are to participate in the company’s destiny. Another tough element in evaluating market value is how to evaluate illiquid assets such as real estate and company lines.

The market value is normally higher than the intrinsic value if there is substantial investment demand, leading to possible overvaluation. The converse is true when there is weak investment demand, which might lead to the undervaluation of the company.

Limitations of Intrinsic Value Investing

Although, Intrinsic value is a primary indicator used by fundamental analysis-based investors to examine a firm. The premise is that it is desirable to invest in firms that have a higher genuine worth than the one being allocated to them by the market. Intrinsic value is a sort of basic analysis. Tangible and intangible variables are evaluated for calculating the value, including financial documents, market analysis, and the company’s business plan.

Not all companies with high intrinsic values are great investments. The future value of a company is expected to be higher than its current intrinsic value. This means the company has a lot of potential for growth, but it also means that its stock price is high compared to its intrinsic value. Because intrinsic value investors are likely to buy stocks that are undervalued, they’re more likely to invest in companies that don’t have a lot of potential for growth.

The other risk is that investors might be too focused on the intrinsic value of a company and fail to notice that its stock price doesn’t reflect that value. If the stock price falls below the intrinsic value, investors would miss the opportunity to make a profit.

Issues with Intrinsic Value

The difficulty with assessing intrinsic value is it’s a much subjective task. There are many variables that must be considered, and the ultimate net current value is quite sensitive to changes in those variables.

Each variable as beta, market risk premium may be computed in multiple ways, while the assumption surrounding a confidence/probability component is purely subjective.

Essentially, when it comes to forecasting, it is by nature, uncertain. That is why , all of the most successful investors around the world could look at the same facts about a firm and come with radically different values for its intrinsic worth.

Wrapping up

Investors who focus on intrinsic value are likely to invest in companies with sustainable competitive advantages and strong fundamentals that are undervalued by the market. While the future value of a company is expected to be higher than its current market value, it also means that its stock price is high compared to its intrinsic value. For intrinsic value investors, the key is to buy stocks that are undervalued by the market. While these stocks may not have a lot of potential for growth, investors who buy them at a low price can make a profit even if the stocks don’t grow.

4 thoughts on “INTRINSIC VALUE 2022 : The 3 Best Investing Scenario”