Debt could be a complex subject to write about. It can be a massive burden on your life and finances. How can you become debt free? There are several ways to deal with it, but the most effective way is to plan for it and ensure you have enough money for emergencies.

[ez-toc]

It is a challenging task to get out of debt when one is in debt. Many-a-times, it’s even harder to confess that there exists an issue related to debt. The guilt that comes with being in debt is yet another shame—the fear of receiving the e-mail, the fear of the next payment, which is on the way.

The dislike of glancing at a bank account, wondering how it will be paid by credit card payment and still be left with money to exist till the next amount. At the moment, one may think, “My debt is spiralling out of control,” but one does not want to address it.

By not addressing the debt, one never establishes a get-out-of-debt strategy, and debt affects more than simply one’s pocket. It influences one’s relationships, one’s work, and, indeed, one’s health. The worry that comes with debt does nothing but affect every part of one’s life.

In our previous posts where we shared important information regarding Value Investing, Intrinsic Value, and Warren Buffett; in this blog, we shall share the four best steps to help you get out of debt forever. Debt sucks, and people are eager to get out of debt painlessly and as soon as possible in today’s society. Everyone, from students to professionals, wants to ensure they have the correct balance between their job and personal life before they turn 30.

With so many variables pulling against you, it’s crucial to grasp how precisely getting out of debt is possible. The key to getting the final word on this problem is simplicity. So, here in this article, we will share four easy steps to get you out of debt and your credit score back up and running again.

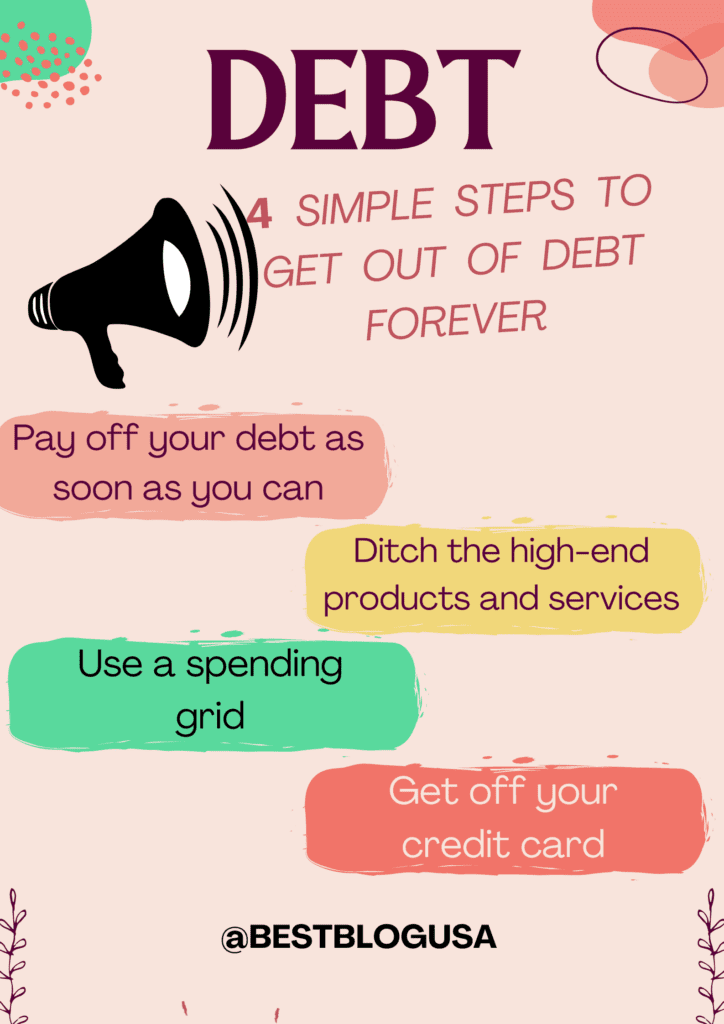

Pay off your debt as soon as possible.

The first step towards getting out of debt is to pay off your debt as soon as possible. It could be a mortgage, a car loan, a student loan, or any other kind of debt that you are currently paying off. You need to make sure you build a budget that will enable you to pay off debt as quickly as possible. If you have a car loan, a student loan, or a mortgage, you can find out how much you can save by refinancing your mortgage and car loans. And finally, you need to set up a payment plan to make sure you can pay off your debt as soon as possible.

Ditch the high-end products and services

While debt is a significant issue in your life, you should also consider ditching high-end products and services. Why? Because these high-end products and services caused you to get into debt in the first place. To get out of debt, you need to ensure that you are not adding to your debt. Instead, you need to ensure that you are cutting back on the things that make you indebted. It would help if you were more selective with the items you purchase. Instead of buying high-end products and services, you should buy basic ones.

Get off your credit card.

When you are in debt and working towards getting out of debt, you need to make sure you get off your credit card. You may think having a credit card is a good idea, but it’s not. Get off your credit card, and don’t even think about opening another one until you get out of debt completely. You don’t want to make things harder for yourself by adding more debt to your plate. Instead, you should ensure that you are paying off your debt as quickly as possible.

Use a spending grid.

When you are in debt, you must make sure you are using a spending grid. The spending grid is a tool that will help you to see where you are spending your money and how you can be more efficient. A spending grid will help you get out of debt as quickly as possible because it will allow you to plan your spending and know how much you can spend on certain things. These simple steps will help you get out of debt and ensure you are out of this situation for good. Make sure you do everything possible to get out of debt as quickly as possible.

Conclusion

If you’re in debt, it can feel like there’s no end in sight. The truth is, though, that you can get out of debt and start living the life you want to live. Knowing what’s going on with your money and where you stand is essential. You never know when an emergency will happen or when you’ll make a mistake that will put you in debt. Keeping your debt in check is key to ensuring your future is secure.

If you’re in debt, you might feel like it’s impossible to get out. The truth is that getting out of debt is possible. If you can track your spending, create a budget, and take advantage of any debt repayment plans available to you, you can get out of debt. It can be a long process, but it’s worth it to get out of debt and start living your life again.