The “Oracle of Omaha” doesn’t need much of an introduction to most people. The 87-year-old is regarded by some analysts as the greatest investor of all time, with a self-made net worth of $84 billion.

[ez-toc]

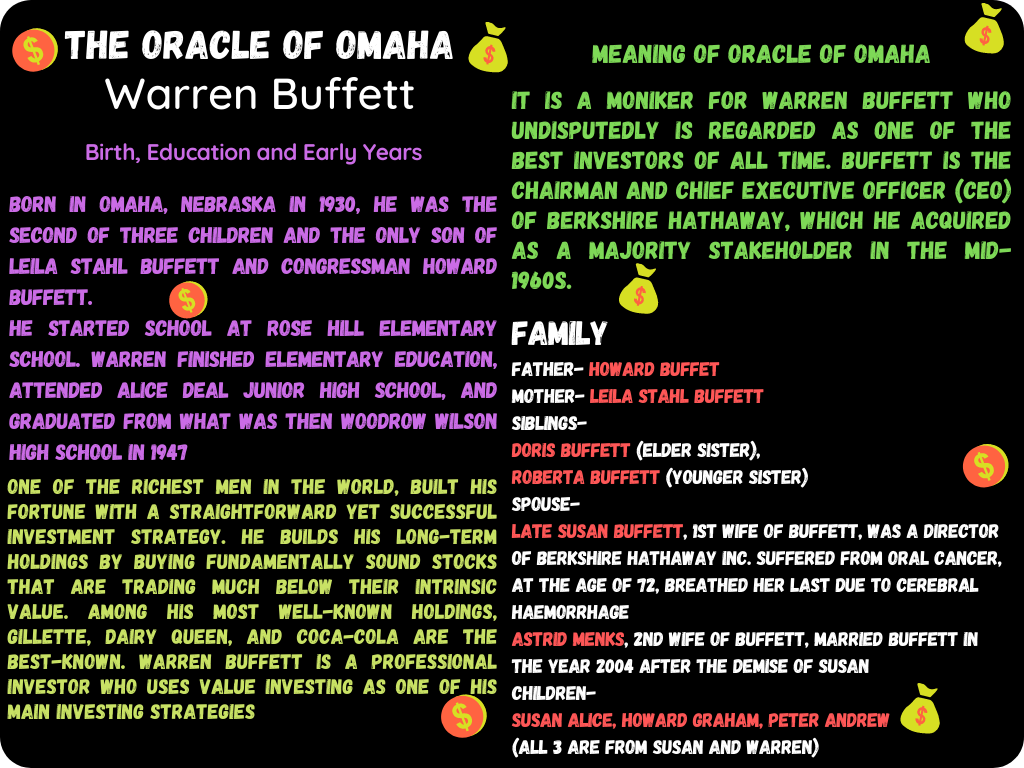

Meaning of the Oracle of Omaha?

It is a moniker for Warren Buffett who undisputedly is regarded as one of the best investors of all time. Buffett is the Chairman and Chief Executive Officer (CEO) of Berkshire Hathaway, which he acquired as a majority stakeholder in the mid-1960s.

He is known as the Oracle of Omaha because the investment community pays careful attention to his investment selections and market analysis, also since he is based out of Omaha, Nebraska. The Oracle of Omaha made his fortune as a value investor by purchasing undervalued stocks with solid fundamentals at a discounted price and retained them for long duration of time. He believes in long term investing.

More about The Oracle of Omaha

Warren Buffett, one of the richest men in the world, built his fortune with a straightforward yet successful investment strategy. He builds his long-term holdings by buying fundamentally sound stocks that are trading much below their Intrinsic Value. Among his most well-known holdings, Gillette, Dairy Queen, and Coca-Cola are the best-known. Warren Buffett is a professional investor who uses Value Investing as one of his main investing strategies

Birth, Education and Early Years of the Oracle of Omaha

Born in Omaha, Nebraska in 1930, he was the second of three children and the only son of Leila Stahl Buffett and Congressman Howard Buffett. He started school at Rose Hill Elementary School. Warren finished elementary education, attended Alice Deal Junior High School, and graduated from what was then Woodrow Wilson High School in 1947, after his father was elected to the first of four years in the United States Congress in 1942. After graduating high school and finding success with his side entrepreneurial and investing activities, he wanted to forgo college and go straight into business, but his father refused.

Family

Father- Howard Buffet (Stockbroker and four-term United States congressman)

Mother- Leila Stahl Buffett (Home Maker)

Siblings- Doris Buffett is the elder sister, Roberta Buffett is the younger sister

Spouse-

Late Susan Buffett, 1st wife of Buffett, was a director of Berkshire Hathaway Inc. Suffered from oral cancer, at the age of 72, breathed her last due to cerebral haemorrhage.

Astrid Menks, 2nd wife of Buffett, long-term relationship, restaurant hostess, married Buffett in the year 2004 after the demise of Susan

Children- Susan Alice, Howard Graham, Peter Andrew (All 3 are from Susan and Warren)

Early age Business and Investing

Buffett demonstrated an interest in business and investment. One Thousand Ways to Make $1000, was a book he got from the Omaha public library when he was only seven years old, which motivated him. Buffett’s formative years were filled with business endeavours. Buffett sold chewing gum, Coca-Cola bottles, and monthly periodicals door to door in one of his early businesses.

He was employed at his grandfather’s grocery shop. He generated money while still attending high school by delivering newspapers, selling golf balls and stamps, and detailing vehicles, among other things. Buffett deducted $35 from his first income tax return in 1944 for using his bicycle and watch on his paper route.

As a high school sophomore in 1945, Buffett and a friend paid $25 on an old pinball machine, which they installed in a neighbourhood barbershop. Within a few months, they had several machines in three separate Omaha barber shops. Later, selling it to a military veteran for $1,200.

Interest in Investing and Stock Market

Buffett’s interest in the stock market and investing began when he was a child, when he spent time in the customers’ lounge of a regional stock brokerage near his father’s brokerage business. His father was interested in teaching the young Buffett, taking him to the New York Stock Exchange when he was only 10 years old. At the age of 11 years, he purchased three shares in Cities Service, preferred for himself and three for his sister Doris Buffett.

Warren earned more than $175 a month distributing Washington Post newspapers at the age of 15 years. In high school, he invested in his father’s business and purchased a 40-acre property maintained by a tenant farmer. He saved $1,200 and bought the land when he was only 14 years old. Buffett had amassed $9,800 in savings by the time he graduated from college.

Buffett enrolled in the University of Pennsylvania’s Wharton School in 1947, under encouragement from his father. Following that, he joined the alpha sigma phi fraternity. He subsequently proceeded to the University of Nebraska, where he graduated with a Bachelor of Science in business administration at the age of 19. After being denied by Harvard Business School, Buffett enrolled in Columbia Business School at Columbia University after learning that Benjamin Graham lectured there. In 1951, he got a Master of Science in economics from Columbia. Buffett went on to attend the New York Institute of Finance after graduation.

Investment Mindset of The Oracle of Omaha

Warren Buffett is a value investor who subscribes to the Benjamin Graham value investing school of thought. Benjamin Graham and David Dodd, both Columbia Business School professors, developed their investing philosophies, which were published in Graham’s book, The Intelligent Investor in 1949.

As a Value Investor, Buffett seeks out firms that are undervalued yet have the potential to earn money. Buffett aims to do this by purchasing firms that are out of favour with the market. He assesses a company’s fundamentals, such as return on equity and profitability, to determine its worth. Buffett prefers companies with a low debt/equity ratio. He prefers earnings growth driven by shareholders’ equity rather than debt.

Warrens 3 best holdings

Among his most well-known holdings, the following are the best-known Gillette, Dairy Queen, Coca-Cola

Other important persons

Undisputedly and arguably Warren Buffett is the best value investor out there, but there are many more, including Benjamin Graham (Buffett’s professor and mentor), David Dodd, Charlie Munger, Christopher Browne (another Graham student), and billionaire hedge-fund manager Seth Klarman.

Suggestive Books/ Good Reads for value Investing

The Intelligent Investor by Ben Graham

The Essays of Warren Buffet by Lawrence Cunningham

One Thousand Ways to Make $1000 by FC Minaker

The Snowball: Warren Buffett and the Business of Life by Alice Schroder

In conclusion

The amount of money that Buffett will continue to contribute appears to be increasing in the future.

“I am not an enthusiast of dynastic wealth, particularly when the alternative is six billion people having that much poorer hands in life than we have, having a chance to benefit from the money.”